Full description not available

L**C

Just what I needed

I am broke adult student due to medical expenses, poor financial literacy and student loans this book is a life saver I am going to work my way through every chapter and change my life. I was able due to NOLO and Obama get my loans into repayment plan that is not a car payment but something much more doable. Thank you for writing this book and do every step down to the last detail and Im sure you will be saved too.

B**S

Looking forward to Reading/Studying...

I was excited about receiving this item to send to my son as a gift. He is interested in learning a few things about managing his finances.However, his review of the book will come later...

K**.

Four Stars

good book and advice.

N**L

Deal with your Finances.....

Great book to educate yourself.....

J**.

Four Stars

good product

C**N

Five Stars

later

I**G

A book that more and more people will need sooner, than later, to help them deal with debt.

There was a time when having huge debt was primarily associated with spending beyond one's available income and amassing huge credit card debt. Today, with mortgage foreclosures (for people who once could legitimately afford their mortgage but now can't do to job loss), the huge cost of medical care (even if you have health insurance and are working!), and the costs associated with natural disasters not covered by insurance policies or government assistance (Superstorm Sandy), more and more working people who live modestly are finding themselves in severe debt.And then there is the issue of the many Americans, of all ages, who are now jobless and even with experience and skills, unable to get a job that pays enough to cover their expenses, however modest.Even individuals and families with substantial savings can find themselves owing thousands from a single medical incident, let alone a diagnosis that requires expensive (and often uncovered) treatment and care--or years of not being able to find work despite their best efforts.People who plan for emergencies find that they simply don't have the money and are forced to charge medical care (often at exorbitant interest rates from the very people who deliver the care--the doctors!) and who are faced with emergencies that even savings can't cover.The point: More and more people who never thought they would be in debt, are, and for the first time ever. They often have no idea what to do and no resources to hire professionals to help. A book like this is a good start to guide them thru the journey out of debt.The book includes valuable information for anyone in debt who is serious about getting out of it, but especially people who are totally unfamiliar with their legal options and how the "system" works in terms of collection practices, dealing with debt collectors, negotiating for payments, etc.It starts with the basics: detailing and prioritizing your debts, critical initial steps that help people realize exactly how precarious their situation is. It then details "What to Expect When You Can't Pay Your Debts," something many people are totally unfamiliar with.There are chapters on how to negotiate with creditors; reducing mortgage payments and dealing with foreclosure; finding money to pay your debts; understanding loan and credit documents (yes, the fine print you haven't been reading); what to do if you are sued; and a general introduction to bankruptcy.Sample letters and forms are included and these will be very useful to those who must take action on their own, independent of legal counsel.The last chapter lists "Help Beyond This Book," an important, must-read section that details how to look up laws; find and hire a lawyer; and tips for finding and working with debt and credit counseling agencies.The Appendices-- a glossary of terms; contact information for agencies and associations; and worksheets--are very useful.Many who need this book will probably avoid it. Confronting the reality of this type of financial situation is painful and scary.Given the times we live in, this is a book a person should read, even if they don't think it will ever be relevant to their circumstances.I've read and used (successfully) a number of Nolo books over the years. They are well-organized and well-vetted, but again, no replacement for legal advice in specific instances. Nolo also has a website with additional information including legal updates, podcasts and videos on related topics. There is a Debt Management Center that includes relevant FAQs, lists of bankruptcy attorneys and debt lawyers and relevant legal forms.

A**E

Read it for the information to help solve your money troubles

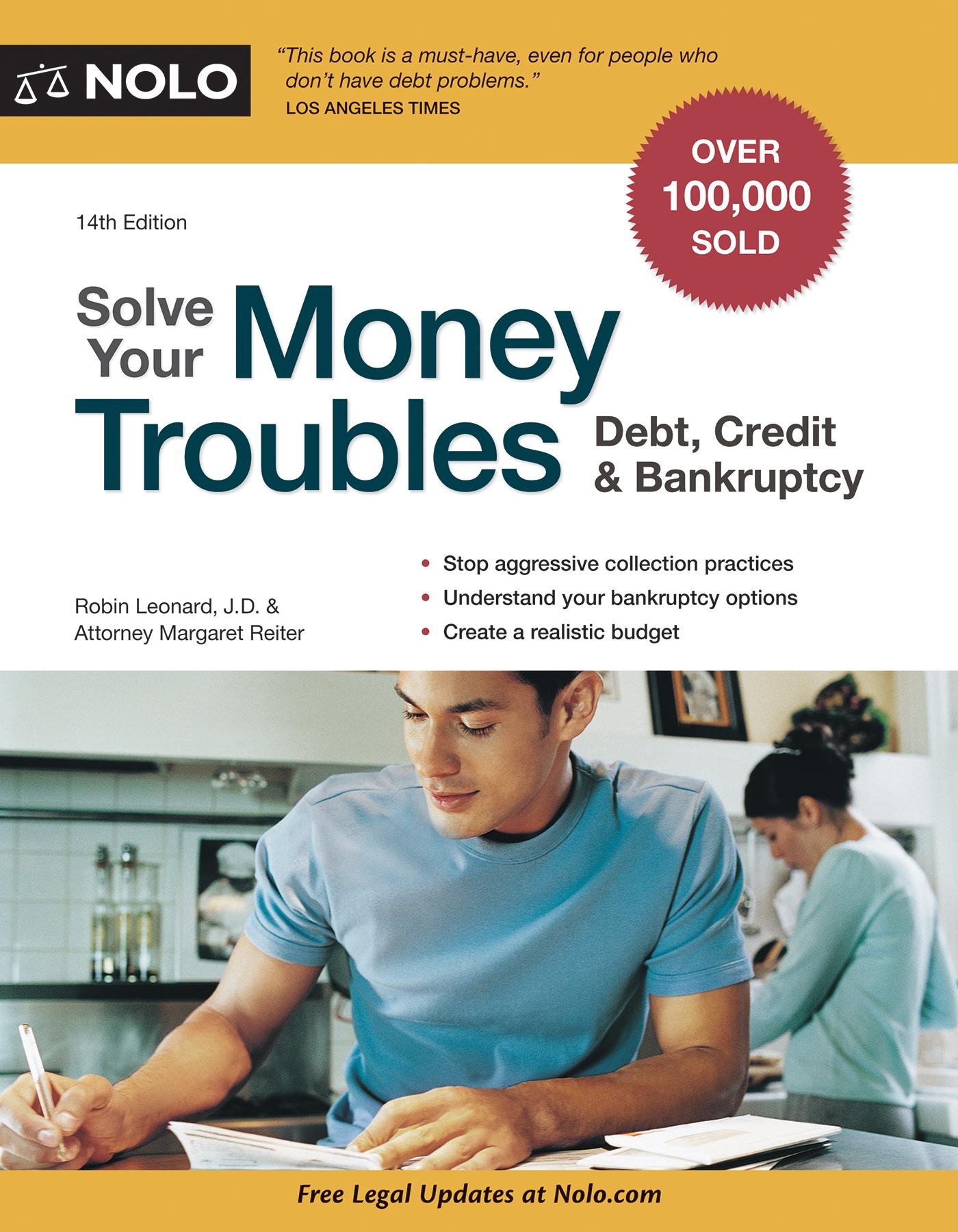

If you are one of the millions of honest, hardworking people that are having troubles paying your debts, Robin Leonard and Margaret Reiter's book "Solve Your Money Troubles: Debt, Credit & Bankruptcy" might be just the book you need to help you get back on track toward a fresh start. This book is a very good tool to help people regain their financial sanity when all debts broken loose.As a Nolo book, it is written by attorneys for the lay person. I've always been impressed by Nolo and the quality of information presented in their products. They are working hard to fulfill their mission of making the law accessible to everyone.The book is designed for people who are in over their heads and need to know what to do now. It starts with a chapter on assessing how much you owe and how much you earn. It then looks at if you are married, divorced, or separated and how that affects your debts.Chapter three outlines debts you may not owe and why, and chapter four goes over prioritizing your debts. The next chapter, five, offers suggestions on finding money to pay the debts you owe, and chapter six provides tips on negotiating with your creditors. If all of that fails, chapter seven looks at what you can expect when you can't pay your debts, and chapter eight covers reducing mortgage payments and dealing with foreclosure.Chapter nine teaches how to deal with debt collectors and chapter ten focuses on choosing and managing credit cards. The next few chapters deal with understanding loan and other credit documents, student loans, child support and alimony, and then a short chapter on if you are sued. (If you are sued, this is a primer, but you will need more information.)Chapter fifteen is titled "Bankruptcy: The Ultimate Weapon" and provides some basics on this option when you cannot pay your debts. If you do choose this option, you will need more information and/or the guidance of an attorney. There are a number of Nolo books on Bankruptcy that could also help.The next chapter discusses property creditors can't take, and then there is a chapter on rebuilding your credit. The last chapter provides some guidance on help beyond this book. There is also a glossary and some sample letters, worksheets, and forms in the Appendixes.This book can be a valuable resource for people who are really having troubles with their finances and difficulties with their debts. Read it for the information to help solve your money troubles.Reviewed by Alain Burrese, J.D., author of Lost Conscience: A Ben Baker Sniper Novel and others.

Trustpilot

3 days ago

1 day ago