Customer Services

Copyright © 2025 Desertcart Holdings Limited

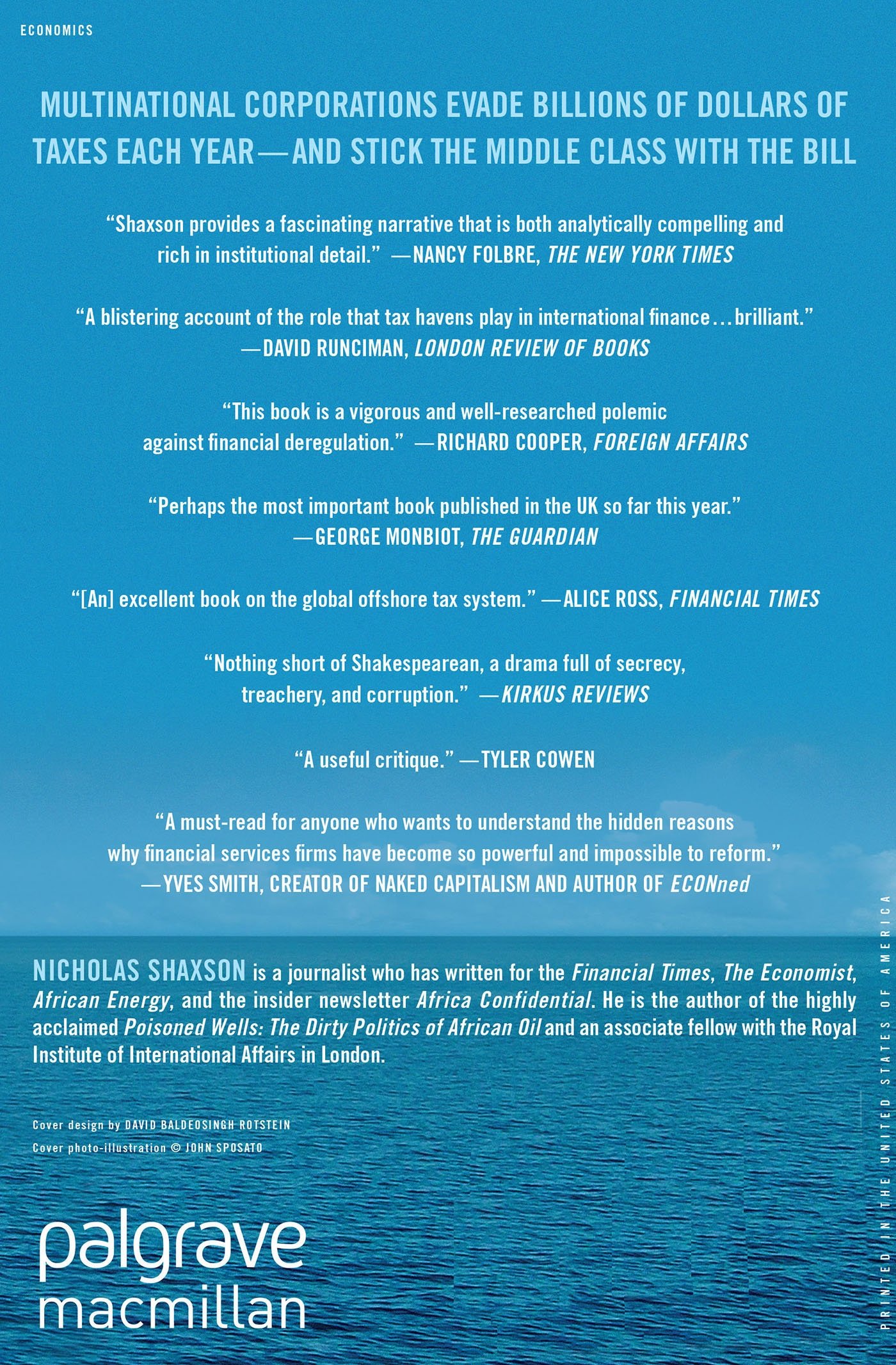

Treasure Islands: Uncovering the Damage of Offshore Banking and Tax Havens

Z**N

Brilliant exposition of an arcane topic

Before I get into my review, I wanted to point out that for someone without a lot of financial knowledge, this could be a very difficult book to read. I have a college degree in accounting, did some graduate work in tax, and worked for one of the big four accounting firms for a year in their international tax consulting department. I quit working for them and left the field entirely after I realized in vague generalities what they were doing, which was one of the reasons I was so interested in this book. The international system Shaxson describes coincides perfectly with what I saw in the accounting firm I worked for, and some of the specific techniques he describes correspond exactly to the tax structures I used to see discussed in trainings and other meetings. Given that background, I found this book incredibly engrossing and informative, but if you have low financial literacy, you may have a tough time with it. However, it is incredibly well written, uses a minimum of jargon, and tries its hardest to break down complex tax and financial concepts into lay terms.Treasure Islands does a really incredible job in shedding light on an arcane, complex international financial system that has evolved mainly over the past 100 years. Like most people, when I heard the term tax haven, I would think of a few rogue Caribbean islands who helped a few rich people and crime lords launder money or hide it from taxation. Shaxson turns that conception on its head. While the term tax haven sounds like it specifically refers to taxes, Shaxon defines it more broadly: "Tax havens can be loosely described as a jurisdiction that seeks to attract money by offering politically stable facilities to help people or business entities get around the laws, rules, and regulations of jurisdictions elsewhere."Using that definition, Shaxson aggregates the international network of such jurisdictions under the label "the offshore system". In this book, he investigates the three main components of the offshore system, which may surprise you. While the small island states are integral fortifications of the offshore system, the main poles are actually the United States, London, and a grouping of states in continental Europe (mainly Luxembourg, Switzerland, Lichtenstein, and the Netherlands). Considering that about one half of world trade passes through tax havens, they are integral to the current global system. Also, while terrorists and crime lords are significant users of the offshore system, the primary beneficiary and architect is the financial services industry. The bankers on Wall Street and in London have constructed a system to help them undermine democracy, drastically boost profits, destabilize the global markets, shape international regulation to their liking, and evade taxes, and this very same infrastructure enables the financing of international terrorism, corrupt third world rulers, and greatly facilitates the illegal drug trade. One key takeaway from the book is that all of these phenomena have their roots in the same underlying financial network, and none of them can be addressed without confronting the offshore system.The main services that tax havens provides are secrecy, tax evasion, and freedom from unwanted regulation. A very important consequence of such a system is the creation of a race to the bottom in terms of regulatory environments. Shaxson examines this process both in the United States and internationally. While the US is an international tax haven (offering secrecy to foreign donors, allowing banks to accept proceeds from criminal activities as long as they were committed abroad, offering tax breaks to foreign investors), there is also a tax haven network at the state level. States such as South Dakota and Delaware, in an effort to attract corporations to incorporate in their states, abolished interest rate caps, giving birth to the credit card industry in the 80s. Delaware also has a long history of offering the most permissive rules of corporate governance, giving maximum power to corporate managers. Barack Obama criticized the Caymans, where he alleged that there was a building where 12,000 corporations supposedly had business offices. Well, there is an office building in Delaware with about 219,000.Internationally, the offshore system allows banks to exercise this deregulatory leverage at the national level. The city of London, which has long maintained an extremely lax regulatory environment for fascinating historical reasons detailed in the book, began attracting massive amounts of business from US banks chafing under the Bretton Woods system of capital controls and Glass Steagall regulations separating commercial and investment banking. London had no such controls, so US banks were able to begin doing business there and use the threat to relocate to London to eventually force the US to deregulate in the late 90s and 2000s. As we know, this was a crucial development in setting the stage for the financial crisis of 2008. In addition, the unregulated markets that were based in London allowed banks to set up investment vehicles that were free of reserve requirements, allowing them to issue massive amounts of debt.A final theme discussed in the book is the devastating effects of the offshore system on poor countries. For every one dollar of foreign aid that has flowed into developing countries over the past 30 or so years, TEN dollars have left the country and into the offshore system, building the portfolios and secret accounts of corrupt ruling elites. The offshore system creates a neocolonial dynamic where western countries back corrupt leaders and their allies, and provide the international financial infrastructure for these corrupt elites to steal their country's wealth and hide it abroad, free of tax. As pernicious as that is, the real consequence to that is that poor populations are saddled with the debt (the proceeds of which the rulers stole), which then of course requires the IMF to come in and radically undermine democracy by imposing harsh structual adjustment programs that mainly benefit rich investor countries and cause great pain to average people.In summary, this book details the most important aspect of the global economy that you probably never knew existed. If you are interested in understanding poverty, inequality, development economics, international terrorism and the drug trade, and how corporations have amassed such great political power, you are missing a huge piece of the puzzle if you don't read Shaxson's epic work.

C**I

Makes a difficult difficult very clear

I didn't find the message of this book particularly difficult to understand as one previous reviewer mentioned, but I do agree with them in that Nicholas Shaxson has made a topic accessible even though it is often considered "too complicated" to seriously examine. The average person probably has a sense that the whole tax system is unfair, but what is often rendered obfuscating are the taxes applied to corporations and the "offshoring" system that has distorted the deregulation of the world economy. What Shaxson does so well is to tie together the concepts of national taxing power, offshore tax havens, a mini-history of tax regulation and corporate tax/profit strategies into a relatively visible whole. It is not a pretty picture.Although I think that this book has a political agenda(His organizatin, the Tax Justice Network is intimately involved in changing the status of tax havens), that is exactly what I find redeeming about his book. This topic rarely gets seen enough through normal political channels and is usually dismissed as too arcane or boring to look at more closely. Shaxson dismisses this notion and passionately argues how the whole system could be transformed through better global cooperation. More democratically agreed upon tax laws and accountability are at the top of the agenda. The "race to the bottom" for the least taxes and regulation are led by offshore havens such as Jersey and the Caymans, US States such as Delaware and South Dakota, and to the ultimate onshore that has become offshore within London itself, the Corporation of London or "The City" as it is often known. The author, born in one of the world's ultimate tax havens for years, Africa, does not like the system he has seen develop there and hopes to prevent the rest of the world from becoming more like that. His country of birth, Malawi, is still one of the poorest countries in the world.I didn't read this book from an academic perspective (ie needing to understand the details about everything inside), but I think I understand enough about how the system works to have a more informed discussion with others and to better understand events in the news as I see them unfolding. This is the kind of book that everyone should be reading, talking about and acting upon. Organizations like the Tax Justice Network and Global Witness provide guidance for future action. Indexes like the Global Financial Integrity Index (measuring corruption) provide a more sobering view of developed countries system of politics than the standard tables (usually providing a broad separation between developed and developing countries when it comes to corruption). This index provides a more holistic view of the how corruption happens, taking into account the effects of unaccountable capital flows, their beneficiaries and the places that make them go. Proposed law amendments such as the White House Interstate Lending Amendment provide an issue to rally around as well as a direction to keep looking, regardless of the comprises that are made in the meantime.It is a fine book in my estimation and perhaps one of the most important to be written since the 2008 financial crisis has shown the widening cracks in the global financial system that ties together our fragile global economy.

B**

the truth about inequality

Well researched and was able to connect seemingly disparate events to a common theme of corruption and cruelty a side of human nature that is selfish and uncaring

Trustpilot

1 month ago

1 month ago